Tron is up 66.5% this week, consolidating gains after South Korea’s failed power grab and martial law highlighted its popularity in that market.

South Korea’s President Yoon Suk Yeol declared martial law on live television on Dec. 3. He claimed that the opposition sympathized with North Korea and declared the activities of the National Assembly (the country’s parliament), other political activities, protests, and demonstrations illegal while also putting media under military control.

This was followed by the military storming the National Assembly in an unsuccessful bid to stop them from voting for the annulment of martial law. After the vote to cancel martial law was successfully concluded, the military dispersed, and the country’s Cabinet lifted martial law just hours after its establishment.

Tron is up 66.5% this week, consolidating gains after South Korea’s failed power grab and martial law highlighted its popularity in that market.

South Korea’s President Yoon Suk Yeol declared martial law on live television on Dec. 3. He claimed that the opposition sympathized with North Korea and declared the activities of the National Assembly (the country’s parliament), other political activities, protests, and demonstrations illegal while also putting media under military control.

This was followed by the military storming the National Assembly in an unsuccessful bid to stop them from voting for the annulment of martial law. After the vote to cancel martial law was successfully concluded, the military dispersed, and the country’s Cabinet lifted martial law just hours after its establishment.

The impact of this sudden chaos on the crypto market was significant, especially considering that South Korea is home to one of the largest and most reactive retail cryptocurrency markets where Bitcoin is so popular that due to strict capital controls, it often trades at a significant premium.

The capital flight from South Korean crypto exchanges that ensued saw major involvement on Tron’s part. Nick Cowan, group CEO at VLRM Capital Management, told Decrypt that “Tron saw enormous buying on the same day, rallying from a low of 200 KRW to a high of 650 KRW, indicating some aggressive switching!”

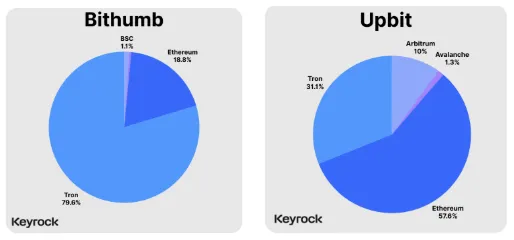

Jan Gobeli, quantitative researcher at Keyrock, told Decrypt that an analysis of the liquidity withdrawn from leading local exchanges UpBit and Bithumb shows “that Tron is one of the most used chains for these transactions.”

Bithumb saw Tron be the most used chain, with over $5.83 million withdrawn through the network. On UpBit Tron was the top choice after Ethereum, with nearly $3.8 million withdrawn. This is about half of a percent of the 24-hour volume reported on the morning of Dec. 3, according to CoinMarketCap data.

Still, Gobeli suggested that South Korean buyers driving Tron price to fuel their capital flight is not as clear cut as it might first appear. He highlighted that “even though the price increased significantly, we didn’t see any indication of buying pressure coming from [top South Korean exchange] Upbit but rather net selling.”

“I can’t confirm that Tron was the major asset used, but the charts would indicate major activity,” Cowan concurred.

Edited by Stacy Elliott.