The condo members at 75 Wall Street aren’t pleased with their new downstairs neighbors.

The residential condo board at the Financial District luxury property, which sits atop the Hyatt Centric Wall Street Hotel, filed a lawsuit alleging that the hotel owes almost $490,000 in common charges and utility charges.

The suit was filed on behalf of the property’s master board, which is composed of three residential board members and four commercial board members, the latter of which are all allegedly affiliated with the hotel. The condo board claims that, in addition to the hotel owner’s failure to pay, the master board has failed to take any action to collect the unpaid charges.

The condominium is made up of 346 condo units and four commercial units, including the hotel.

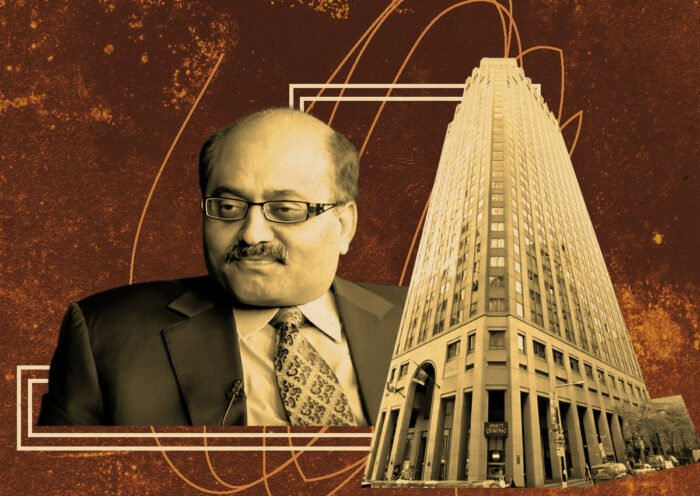

At the end of 2021, Navika Capital’s Naveen Shah paid $85 million to buy the hotel from the Hakimian Organization, which developed the original site and retained control of the unsold condo units at the time. The hotel is controlled by a single-purpose entity.

The lawsuit claims that the unpaid charges, and the master board’s unwillingness to collect them, has left the condo board “unable to meet its financial obligations, including payment of service vendor invoices, insurance, and utilities.”

A representative for Navika Capital did not immediately respond to a request for comment.

The condo board claims that the hotel stopped paying utility charges as recently as Jan. 2023, and has not kept current with common charges and special assessments levied since April 2024.

According to the lawsuit, the building’s managing agent received emails and calls on a daily basis from vendors, who eventually threatened suspending service and filing clients.

The condo board claims that the master board and hotel owner evaded efforts to settle up the alleged debt, including skipping a special meeting in June and disregarding a proposed $1 million special assessment from the building management agent.

The lawsuit grants that Shah, on behalf of the hotel, made some payments, but in response to an June 26, 2024 email from the managing agent stating that the hotel unit was still almost $260,000 behind on payments, Shah allegedly replied: “As stated many times in the past, we are of the opinion that hotel has overpaid for all of charges in the past.”

During a special meeting on March 19, 2025, lawyers for the master board recommended placing a common charge lien against the hotel unit and pursuing foreclosure, which the master board voted down.

Shah is also facing another previously unreported lawsuit after he allegedly failed to contribute over $2.4 million dollars to the New York Hotel Trades Council and Hotel Association of New York City benefit funds, including health and pension funds.

The New York hotel groups filed a lawsuit against the hotel’s ownership entities in May 2024 after the hotel allegedly failed to honor an arbitration award.